Financial data has become one of the most valuable assets for both individuals and businesses. But they are also one of the most coveted by cybercriminals.

Credential theft, fraud, leaks, or identity theft are threats that grow daily and are no longer limited to large corporations or banks. Today, anyone with a bank account or investments is a potential target.

Protecting financial data is not just about security but also about trust, stability, and prevention. However, most of the time we continue to act when the damage is already done. and therein lies the significant difference between reacting and anticipating: in the first case, we try to put out the fire; in the second, we prevent it from starting.

Qondar, the tool that helps you anticipate

Before we delve into how to protect your financial data effectively, we want to mention a solution we’ve designed precisely for that purpose: Qondar.

Qondar is a tool for cyber surveillance designed for individuals and grounded in the principles of Continuous Threat Exposure Management (CTEM). Simply put, it means not waiting for an attack to occur before taking action. Its approach consists of monitoring, detecting, and anticipating potential data leaks or exposures of personal and financial information online, on both the visible and dark webs.

Thanks to this continuous monitoring, Qondar helps identify early signs of risk, such as leaked credentials, compromised accounts, or sensitive information published on forums or in databases. In this way, users can react before the problem becomes a real loss.

If you’re worried about digital security, of your personal and financial information, now is a great time to try Qondar and discover how it can help you stay one step ahead of threats.

Why protecting financial data should be a priority

In Spain and around the world, we’ve seen an increase in attacks related to the theft of financial data. It’s not just about large-scale operations: many begin with simple phishing emails or unauthorized access to personal financial accounts.

At an individual level, the most frequent risks are:

- Theft of bank credentials through phishing or malware.

- Identity theft to apply for credit or to make fraudulent purchases.

- Unauthorized access to wallets or investment applications.

- Personal data leaks that allow for the creation of financial profiles.

For companies, the impact can be devastating: loss of customers, legal penalties, reputational damage, and recovery costs.

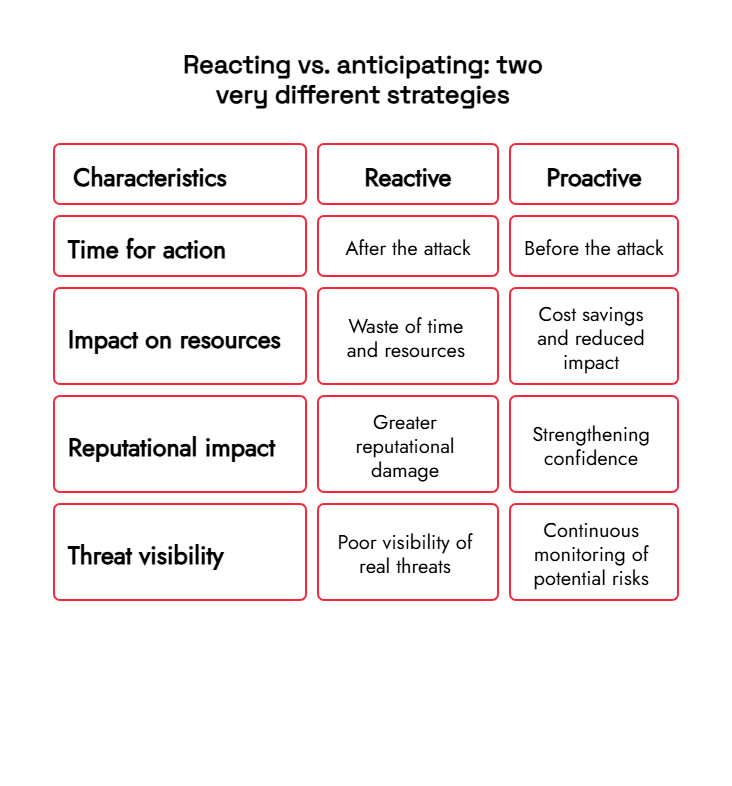

Reacting vs. anticipating: two very different strategies

When a data breach occurs, many people and organizations follow the same pattern: they discover the problem when it’s already too late. This is the reactivo: se actúa después del ataque, tratando de reparar los daños, avisar a los afectados y reforzar las medidas de seguridad que ya han sido vulneradas.

In contrast, the proactive or anticipatory approach seeks to detect vulnerabilities before they are exploited . by providing visibility into where and how financial data could be compromised and acting proactively.

The practical difference between the two approaches is enormous.

In other words, anticipation not only protects but also strengthens.

If you want to delve deeper into the term proactive approach, access our blog post→ Proactive security: what is it and why use it to prevent and detect threats and cyberattacks?

How to anticipate: the importance of the CTEM model

The CTEM approach starts with a simple idea: It is not enough to analyze risks once a year or after an incident.. Threats change every day, and security solutions must change too.

The CTEM model, used in solutions such as Qondar (for individuals) and Kartos (for companies), is based on three fundamental pillars:

1. Constant visibility

This is about maintaining active, continuous vigilance over the information circulating online. This includes detecting whether your financial data appears on forums, in illegal marketplaces, or in compromised databases.

With Qondar, this process is automated and updated in real time, avoiding reliance on manual or occasional reviews.

2. Exposure assessment

Not every exposure poses an immediate threat, but it’s crucial to know what information is at risk and which one could be used against you. This analysis allows you to prioritize protective actions, focusing on what is truly urgent.

3. Early response and correction

The last step is to act quickly. When an exposure is detected. Qondar provides early alerts so users can cambiar contraseñas, revocar accesos o contactar con su entidad financiera antes de sufrir un ataque directo.

What can a person do to protect their financial data?

Although technology is essential, awareness and good practices remain the first line of defense. Some basic measures include:

- Avoid reusing passwords, especially for bank or investment accounts.

- Activate the two-step authentication on all platforms that allows it.

- Do not share personal or banking information through unverified emails or messages.

- Periodically check if your email address or data appears in filtered databases.

- Keep your device and app software up to date.

The key is to make protecting financial data a continuous habit, not in a one-off reaction to a threat.

Enthec: Cybersecurity as a process, not a patch

At Enthec, we specialize in offering solutions that integrate with this continuous, proactive approach. Our Kartos tool, for businesses, and Qondar, for individuals, enable dynamic management of exposure to threats and adaptation to changes in the digital environment.

Both solutions are designed under the philosophy that cybersecurity is not a product, but a living process that requires constant review, learning, and evolution.

In matters of financial data protection, responding can be costly. Not only in economic terms, but also emotionally: stress, loss of confidence, or the time spent regaining control are invisible but real costs.

Anticipating, on the other hand, is a way of safeguarding peace of mind.. Thanks to tools like Qondar; this prevention is no longer a luxury reserved for experts or large companies, but something accessible and valuable for anyone connected to the digital world.

Take the step towards more conscious and preventative security. Discover how Qondar can help you protect your information and your financial peace of mind Contact us